Simulating Metal Production

February 23, 2022

I had the opportunity to assist Trident Royalties with their due diligence on several mineral assets. As royalty companies tend to do, Trident was looking to pay today for the benefits of metal production tomorrow. The forecasted future production for these assets was neatly presented to us in an Excel Spreadsheet with ensuing cashflows judiciously discounted. Our collective task was to size-up the uncertainty around those forecasts.

Given the number of producing assets to look over, this was already a challenging exercise. Further, some assets were, by various degrees, in development with no guarantee of ever reaching the production stage. All had some form of upside potential through mineral reserve expansion. None were immune to the risk of production disruptions or early closure. In short, each property was beset with their own unique risk profile and the breadth of possible outcomes for such an ensemble of assets is difficult to appreciate.

Once appreciated, how do I even go about expressing the extent of uncertainty that the due diligence reveals? It would be easier to avoid talking numbers and stick to emotions, providing a long narrative describing the qualitative nuance of all of my hopes and fears. Unfortunately, this is not much help to those who aspire to be rational decision makers. To place a calculated bet on future metal production, you want to know the odds and, if you need the odds, you have to get quantitative. I found working on such an approach made for a fascinating challenge and the broad concepts are worth sharing.

"Getting quantitative" sounds serious but is still pretty vague, so let me get a little more explicit. First, I take the broad question about future metal production and reduce it to a handful of critical questions; all the while being careful to pose those questions such that they can be answered probabilistically. Second, using data analysis and expert opinion, find the probabilistic answers to those critical questions. Third, build a system that logically ties the forecast production to those questions and can randomly draw from their respective probabilities. Finally, run simulations of future outcomes, painting a picture of the uncertainty faced.

It is important to note here that, while quantitative, this approach is still highly subjective. Choosing the critical questions, data to analyze and experts to engage all comes down to an individual making a call. It is not about objective truth. Rather, it is about tabling opinions in a highly explicit fashion. Doing so consistently allows for reconciliation as the future unfolds providing opportunities to temper the next opinions we forge. This is my party, so you are stuck with my views for the moment.

Production schedules are quite specific, stating how much metal is to be produced each period from mine startup until closure. These are estimates and we expect them to provide some information about the future reality. That said, we also expect reality to deviate from those estimates in a way that cannot be determined beforehand. The estimate represents a deterministic component of the future that is coupled with random components, those critical questions that describe the essence of my uncertainty. To start, I need to guess at the type, size and shape of those random components. Here's how I break it down:

- What are the odds production will be achieved?

- If production is achieved, how soon until startup?

- What are the odds that future production encounters unforeseen disruption?

- If disrupted, what are the odds production returns to normal?

- If mitigated, how long will the disruption last?

- Barring delay and disruption, how accurate/precise is the forecasted production?

- What are the odds that the reserves expand?

- If expanded, by what factor will the reserves grow?

Each of my critical questions above can be answered probabilistically. To start building those answers, I analyze historical data for mineral properties throughout the world, making the epistemological leap that the past is a good model for the future. My chosen dataset comes from S&P Global's Market Intelligence Platform. Here are the provisional answers I get from this analysis:

What are the odds production will be achieved?This is trivial for operating mines as the odds of startup are 100%. About half of projects that get through the Feasibility Study (FS) stage move on to become producing mines. Now, if management also announces a projected startup date, I give them slightly better odds (60%). Further, if they make a clear announcement that a production decision has been made, I can see pushing those odds to 75%.

If production is achieved, how soon until startup?Those FS stage projects that make it to production do so in about two years of completion of the study. The lucky ones come in within a year and it is 3 years or more for the unlucky ones. Where management announces a startup date, there are even odds that it will take at least 6 months longer with a decent chance the delay will exceed two years.

What are the odds that future production encounters unforeseen disruption?About half of the operations I reviewed experienced one or more disruptions to production, a quarter of which appear to only be partial rather than a full cessation.

If disrupted, what are the odds production returns to normal?Sometimes a temporary disruption turns into a full blown mine closure. It looks to me that two thirds of disrupted operations get it back together.

If mitigated, how long will the disruption last?The tea leaves are harder for me to read on this one, but I make it that 25% of the time the disruption lasts less than 3 months, half the time its less than a year, and 2 or more years for the unfortunate 25% at the other tail of the distribution.

Barring delay and disruption, how accurate/precise is the forecasted production?Assuming a smooth startup and no disruption, forecasts still do not perfectly align with realized production. As you might expect, short range forecasts (say less than one year) are pretty good. I see these as unbiased and falling within 5% of actual production about half the time. The long range forecasts that you find in an FS are biased high. I figure that half the time actuals come in 10% lower than forecast and 40% lower for the bottom quartile. However, it is not all bad news. The top quartile see +15% more production than predicted. Still, that is a considerable range.

What are the odds that the reserves expand?This is another coin flip. I see about half of initially reported reserves get bigger over the ensuing years.

If expanded, by what factor will the reserves grow?Half will add 50% or more with the top quartile adding more than 150%. For the bottom quartile, it's 20% or less.

Let me stress again that these answers are the starting point. In terms of Bayesian Inference, they represent the mining industry's priors, short for prior distributions. As the due diligence process uncovers relevant knowledge, warranted tweaks to these priors convert them to posterior distributions; the stronger the evidence, the larger the tweak. This knowledge can take the form of additional data relevant to a particular case. Frequently, it will take a more implicit form such as the intuitions and opinions of experts.

Fitting the posteriors into a system that simulates future production takes a bit of effort, but is entirely achievable in Microsoft Excel without any VBA. My approach, at a high level, is to take the production schedule as given and run through randomly generated scenarios where the timing and quantity of metal production is stretched, compressed, shifted, truncated and perforated; all consistent with my posterior distributions. All generated scenarios are equiprobable and analysis of those scenarios is a simple matter of counting; for example, one could count how many scenarios produce over 500k ounces of gold by year 2030. This analysis is then neatly summarized in a graph allowing the observer to quickly perceive the extent of uncertainty around future production of the mineral asset.

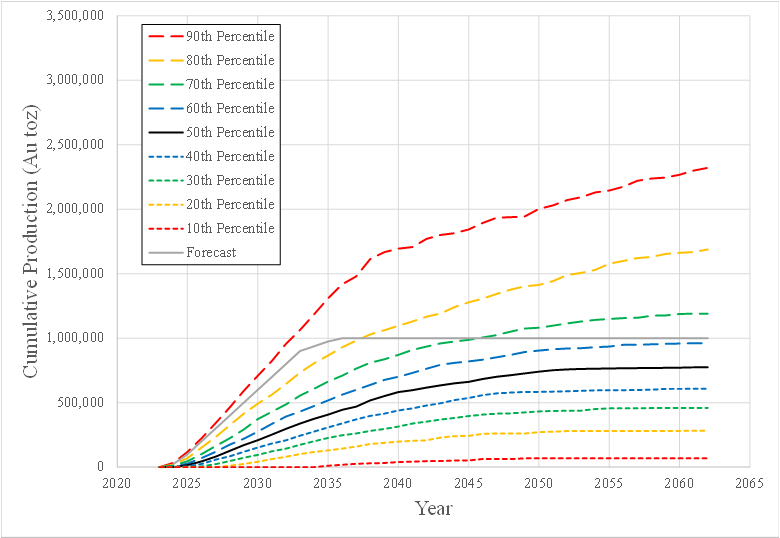

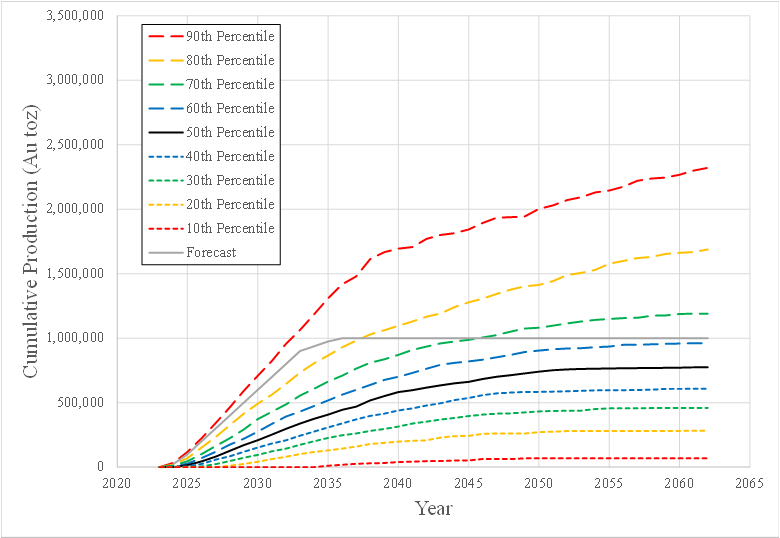

Here is an example situation: A management team has recently announced their decision to build a gold project forecast to produce 1M ounces over 12 years starting in 2024. Potential financiers of the project require an opinion on the certainty of future gold production. With the information above and the forecast production I can use my prior distributions to quickly table the following provisional assessment of uncertainty.

At this point, I show that nearly 90% of my simulated scenarios fail to hit the planned 1M ounces by 2036. Also, the odds that this operation will ever clear 1M ounces of production over the next quarter-century are less than 30%. About half the time the operation will fail to clear 500k ounces in the same timeframe.

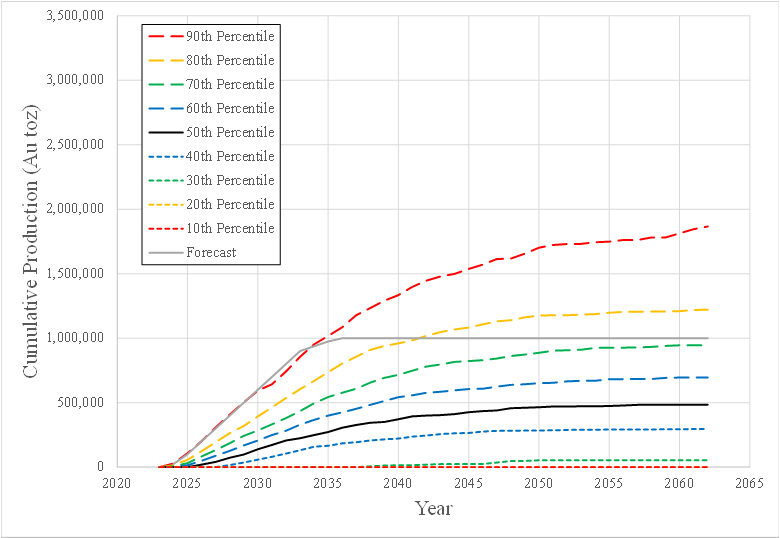

This view is provisional as I have ignored all but the most cursory knowledge of the project. Perhaps a week's worth of due diligence reveals some good news such as a highly qualified management team, a friendly socio-political environment, and a highly certain opportunity for reserve expansion. After careful consultation with trusted experts, I modify those prior distributions to reflect the updated knowledge and repeat the assessment (updated graph below). Now we can see clearly the implications of these improved prospects. The odds of failing to produce 1M ounces by 2036 have dropped from 90% to nearly 80%. Eventually hitting that 1M ounce mark is up close to 40%. Further, there is nearly a 70% chance of exceeding 500k ounces of gold production.

I have stopped short of any economical evaluation but that is the logical conclusion. With these production scenarios established, one can start applying some economic assumptions and reframe the production uncertainty into payoff uncertainty. That view of payoff space is what I would want to see before taking a calculated bet on future metal production.

On a grander scale, opportunities to carry this work forward abound. Certainly, revisiting the critical questions and their prior distributions could bear additional fruit. Perhaps the historical record tells a different story for mineral properties based on commodity, climate, or geology; a little machine learning might help tease out these relationships. Further, I am guessing a look at historical commodity price movements will provide some signal as to the timing of startups and disruptions. Please reach out if you see an opportunity to apply or improve this approach.